One of the best modes of transportation from one location to another is via a two-wheel drive. As it is cheaper than a car, you can quickly obtain a small loan to cover the costs without affecting your cash flow. Having a good CIBIL score is one of the things that can affect your bike loan. But, how much credit score do you need to have? You can check this information in Bajaj Markets. Though before that, knowing about its importance is equally crucial.

Importance of CIBIL Score Before Taking a Two-wheeler Loan

It is essential to have good credit if you want to get a two-wheeler loan. It can help you get better loan terms, like lower interest rates, more flexible payment choices, and less of a down payment. So start focusing on your credit score and improving it before you want to get a two-wheeler loan to buy your dream bike or scooter.

Interest rates get lower for people with better credit. If your credit score is above 750, you should be able to get the best rates on two-wheeler loans. Rates of interest go up when credit scores go down. If your number is less than 600, you may have to pay more interest, making the loan more expensive.

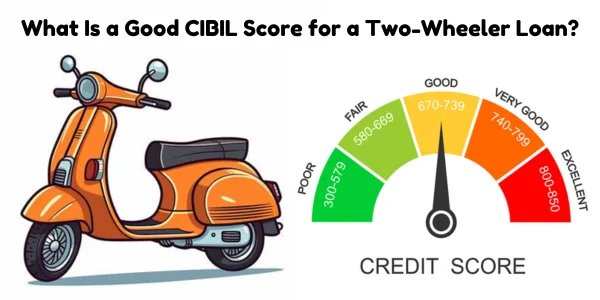

The Minimum CIBIL Score Required for a Two-wheeler Loan

There are many ways to know your CIBIL score online. For a bike loan, your CIBIL score should be at least 750. A number above 750 is excellent, and that’s all you need to get a two-wheeler loan. If your CIBIL score is between 650 and 700, you can get a bike loan as a protected loan. There are other things that lenders look at as well to see if you can get a bike loan. This covers the loan type, late payments, and the income.

What Affects Your CIBIL Score?

Banks look at your CIBIL score to decide what kind of loan you can get and whether to give you one. Credit scores are affected by several important things. Here is a list of them:

● History of Payments

You have paid all of your EMI and credit card bills on time. This is called your payback history. So, your CIBIL score will have a significant effect because of this. This number will increase as long as you pay your bills on time.

● Credit Utilisation Ratio (CUR)

When you compare the amount of credit you have used to the amount of credit you have available, you get your credit usage ratio. The best thing to do is to keep your CUR below 30%. If your CUR is high, it might look like you rely too much on credit.

● Credit Age

How long your credit information has been open is called your credit age. The investor will trust you more if you have a more extended credit background. You should be very careful when you close old credit card accounts.

How Can You Improve Your Two-wheeler Loan?

Buying a two-wheeler can be easier and faster if you get a loan with the help of Bajaj Markets. There are some good things you can do to improve your chances of getting a two-wheeler loan quickly.

● Check Your Credit Report

A good credit score shows you can be trusted to repay loans. Most lenders will give you a bike loan if your score is 650 or higher. So, check your score before you apply.

● Keep Your Earning History Steady

Lenders like to lend money to people with a steady income because it shows they can repay the loan. For paid workers, a steady monthly income is helpful.

● Make Sure Your Debt-To-Income Level Is Low

Lenders look at your debt-to-income relationship to see if you can handle more debt. Your monthly debt payments shouldn’t be more than 40% of your cash.

Documents Required for Two-Wheeler Loan

If you want to take a loan for a bike, you must also send in paperwork for a two-wheeler loan. The bike loan is given to you after the necessary paperwork is checked. First, look at the documents you need to apply for a loan.

● Proof of Identity (ID)

First, submit your Proof of Identity or ID. It proves your identity include your PAN card, Aadhaar card, driver’s license, and more.

● Address Proof

You also have to show proof of your home location with your ID, rental agreement, or electricity bills. It is can as proof of your home address.

Conclusion

You can get a better bike loan if you know what factors affect the interest rate on a two-wheeler loan. Not only this, you also can get a lower interest rate on a bike loan when you know your CIBIL score, pick a good term, make a reasonable down payment, and enquire at different banks.